1. Acorns

Acorns is an application that is set to be released in July 2014 on the App Store. The app allows you to invest the small spare change, or any amount you choose, into a diversified money market account. Through this, you can gather profit from small and large companies, government bonds, and more. Love: Makes investment more approachable for the average individual who may be scared off from the idea of a sophisticated investment portfolio. Hate: You must use your bank account for investments. Understandable to prevent credit card debt, but some individuals may prefer other options. iOS ($1/month) – Android ($1/month)

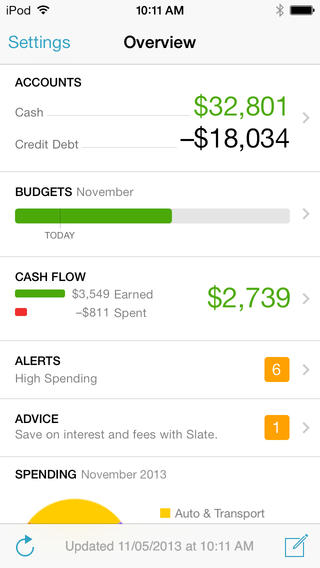

2. Mint

Mint allows you to get a holistic view of your finances, including advice on problem areas. When your active accounts are connected, you are able to get a full view of your cash flow, taking into consideration credit card charges and income as well. Love: You are able to stay on top of your finances and even get emails when you are falling off the wagon of financial health. Hate: Sometimes, budgets aren’t accurate, which requires having to stay on top of the application more than your finances sometimes to ensure things are properly allocated. iOS (Free) – Android (Free)

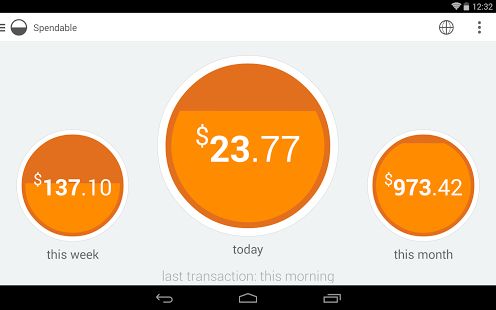

3. Level Money

The main appeal of LevelMoney are the informative info graphics that allow you to stay on top of your finances, savings as well as spending habits. Plus, as shown above, you can get an easily digestible view of your day, week, and month. Love: Simple, easily digestible, and informative. Hate: Some may want a little more out of the application, in terms of financial management. iOS (Free) – Android (Free)

4. Scanner Pro

Having a digital form of your receipts and financial forms can allow you to ensure that you can easily access important documents dealing with your money. Scanner Pro brings scanning capabilities to your iPhone, allowing you to export as a PDF all within your iPhone itself. Love: Great way to digitize papers on the go. Hate: For $2.99, the capabilities that come with the app may not be worth it to some, who may simply substitute by taking a photo instead. iOS ($2.99)

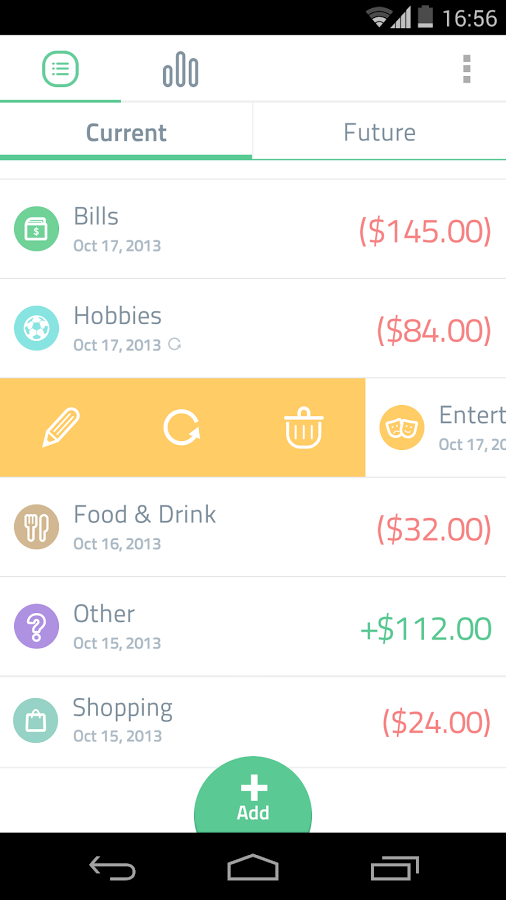

5. Spendee

Spendee is a very minimalist financial advice application that analyzes your spending habits to provide you tips on how to spend your money wisely. Your savings activity is also monitored to ensure that you are working toward a plan of building wealth for the future. Love: The ability to export your spending and income into an Excel document. I also love the ability to take photos of bills and receipts all in an app worth gorgeous graphs. Hate: Financial information focuses more on the month to month, rather than continuously offering your financial state. iOS ($1.99) – Android ($1.99)

6. BillGuard

BillGuard allows you to stay on top of your finances to build wealth through keeping track of the bills and other aspects of spending to ensure that you are on a path of financial health. The “guard” aspect of BillGuard comes with the fact that your cards are protected from fraud. Love: Security of cards through notifications of suspicious charges and activity. Hate: Improved categorization needed. iOS (Free) – Android (Free)

7. Expensify

Simply attach your accounts and get expense reports easily downloadable on the application. Several of the features in the application make it welcoming to frequent travelers and business users alike. Love: Currency conversion is a great pull feature for travellers, including the ability to import flight information. Hate: iPhone seems dependent on the web component. iOS (Free) – Android (Free)

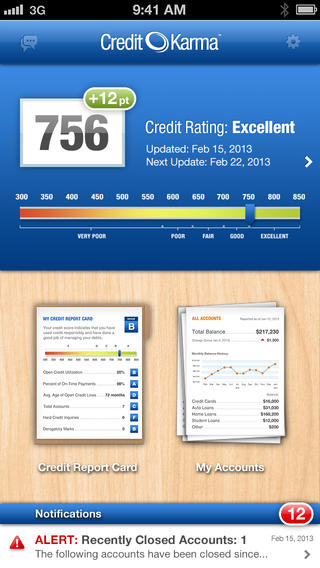

8. Credit Karma Mobile

The most important gate to building smart wealth is through having full knowledge of your credit score and history. Credit Karma is a big name in credit scores and the application allows you to stay on top of it while also keeping track of your financial accounts connected to the app. Love: You truly get your full credit report for free, without any hidden fees. Hate: None. iOS (Free) – Android (Free)

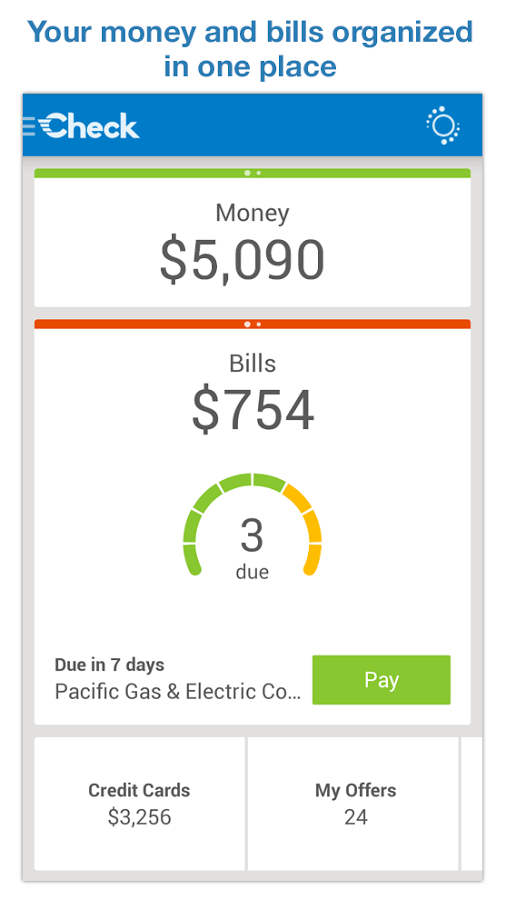

9. Check

Stay on top of your due dates and credit limits. This is the application that ensures that you are on top of bills and ensures that you aren’t going to have a high utilization percentage on your credit cards. Love: Beautiful application that alerts you when due dates are nearing. Hate: Account management issues; including separate accounts under the same company. iOS (Free) – Android (Free)

10. Bloomberg

Staying on top of market news and updates of the stock market will help you to come to a better conclusion on the right time to invest in a specific company. Bloomberg for iOS and Android ensures that you become well versed in all things in financial current affairs. Love: Easy to use and minimalist, while continuing to give a determined and serious user interface. This is the app to get the news you need on finance without fluff. Hate: Geared toward those a little bit more versed in the financial markets, not exactly for fresh beginners yet. iOS (Free) – Android (Free) Featured photo credit: Frontspace via frontspace.com